Creating a mobile banking app with 148 screen designs in just 3 months sounds pretty impossible. And yet, this is what actually happened.

The digital race begins in Retail Banking

The year 2018 was a game-changing year for retail banking. As PSD2 (Revised Payment Service Directive) was implemented, and the banks’ monopoly on their customers’ account information and payment services started about to disappear. The new EU directive opened the door to any company, particularly to adaptive fintech startups, who threaten to eat the banks’ lunch. These market challengers, like Transferwise or Revolut may soon be able to manage customers’ finances as third-party providers. In the near future, customers may be using social media or other online platforms to send money, pay bills and analyze their spendings, while still having their actual money safely guarded in their current bank account. According to the directive, banks are obligated to give access for these third-party service providers to customers’ accounts through open APIs (application program interface).

Erste Bank entering the digital race

Erste is one of the largest retail banks in Hungary providing a wide range of banking services to more than one million customers. The company’s existing mobile banking application was a trending touchpoint with the clients, however it abounded with countless usability issues and had to be reimagined along user experience considerations. The pressure on the bank was twofold; their incumbent competitors progressed better on the online sphere, while it had to comply with new EU regulations and prepare to the challenging era of PSD2.

It is clear that a new era of competition is arising on the retail banking market; fintech predators will soon be enabled to build financial services using the banks’ data and infrastructure, while banks will not only have to compete against other banks but everyone, who wants to offer financial services. PSD2 will fundamentally change the payments value chain and therefore, customer expectations.

And this was where Digital Natives could help.

Digital Natives as the Pit Crew

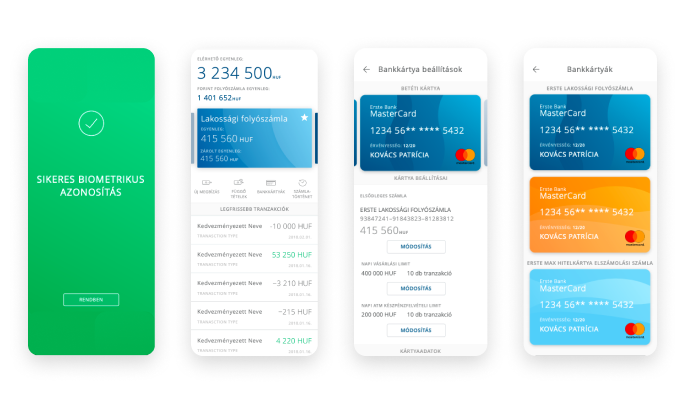

To boost our client in the competition for online banking touchpoints, we were eager to imagine a retail banking app offering outstanding customer experience. Our goal was therefore to perform a research-backed user experience re-design of the widely used retail banking application to keep pace with market trends and competitors – in less than 4 months. Hence, our mission was to design a new app with high usability standards and a fresh appearance allowing the client to stay in the game. In order to achieve this goal, we had to conduct a comprehensive UX research, plan all new customer journeys from money transfer to TouchID settings and design a one-of-a-kind interface in an extremely short time.

Moreover – as it was a UX/UI re-design – the new journeys had to be adjusted to the old backend systems of the bank, but in parallel, all of the features and customer processes had to comply with the new secure banking directive of the EU. We had to learn about an enormous amount of new security and online banking standards to meet the legal criteria and to be creative in matching the new functionality with the constraints of the old back-end.

The tools we used to meet the challenge

To meet the challenging deadline, 6 of us were working on the project collaborating iteratively with the client and also with a third party development agency, who was responsible for the actual coding of our validated journeys and design. We were in constant communication with the client and the external agency to lead the development process and to ensure smooth information flow between the parties. We organized sprint planning and review meetings, retrospectives, daily standups, brainstorming events and on-site days to make progress with a necessarily high speed.

In line with our company credo, we provided full transparency to our client about the progress, finances, processes, mistakes, obstacles and the hindering factors of the bureaucracy in the bank. We were able to work with the client as equal partners; we had the required authority to make professional decisions, while we took into account all inputs and limitations – be it legal or technical – to meet the countless expectations of various departments in the corporation.

Everybody in the team was eager to create an awesome product and also to meet the strict deadline. To do so, not only the application was redesigned; being some kind of meta consultants, we also re-engineered our SCRUM-based in-house design and communication structures while working on the project to fully align with the challenge and its purposes. That’s what we call agility!

During the research phase, deep interviews, competitor product analysis, market trend analysis and a comprehensive UX audit of the old application were conducted together with a quantitative analysis of usage data provided by the bank. Based on the research, we were able to identify the main pain points and usability mismatches of the old app and define the user persona and the design persona. We applied design thinking and lean methodologies during the re-imagination of the app to exceed the serious expectations of the bank’s customers.

To achieve the highly challenging project goals, we collected a huge amount of information about users deliberately aiming for the highest usability. We spent more than 200 hours on-site and on the field interviewing financial and customer complaint experts from the company, understanding banking systems, legal and security constraints and the given limitations for the planned user journeys. After processing all available information, we put together three main UX concepts and together with the client we carefully chose the most appropriate one taking all researched customer expectations and business constraints into account.

Designing never stops, not even in our dreams

During the design phase, several variations of customer journeys and user flows were designed to understand and map banking processes and to find the best solution through the design iterations. Applying agile methodologies, we worked in a highly tailored SCRUM with 2-weeks sprints (phases) during the concepting and high-level wireframing phase, switching to 1-week sprints when faster iterations became necessary because of the complexity of the tasks and the required inputs. We created countless wireframes, transformed them to high-fidelity ones and finally provided clickable prototypes of each and every user flow.

Focusing on the interface, numerous versions of the UI stylesheet, self-made icon sets and icon font files, design guidelines and detailed functional documentation were produced to every function, feature and screen. It was an interesting challenge to create a unified app, which looks good both on Android and iOS and has gestures understandable for both user communities.

Reaching the finish line

We worked day and night on the project, in the end we saw the banking mobile screens in our dreams, too. However, finally we synthesized the vast amount of customer data, transformed it to a market-ready concept and produced several hundreds of wireframes and other design outputs to end up with 148 final wireframes and 148 graphic design screens.

After this fierce period, the development and the actual market launch of the app took place according to the predetermined plans; we met the final deadline, which is arguably rare considering IT development projects.

The bank has got a fully reimagined app with validated customer journeys, a trendy look-and-feel, and incomparably fewer usability issues. High usability standards were achieved based on user feedbacks and quantitative KPIs. With the new app, it takes significantly less time and fewer click to perform the main retail banking activities, such as money transfer or daily transaction limit increase.

Our client was highly satisfied and we also really enjoyed working on the project. One question still remains unanswered, if the app will stand the test of PSD2. Stay tuned!

Have a look at our social media